Hi! I’m glad that you open up the web, here are some more details about my ESG project.

There’s really not much space to tell through the poster, so I’ll try to explain my work to my best effort here.

Also, there is a simplified Chinese version, welcome to check on that: 中文版點這裡

Check out the github repo as well: https://github.com/KIYAS008/topic_research_IV_esg

Here are some guidence QA:

- What is ESG?

- What happened to the U.S. stock market during early 2020 pandemic?

- Why Covid-19 market crashes are suitable for analyzing stock price resilience?

- Are there related work?

- About the ESG data

- About the methodology

- Key findings and analysis

- Conclusion

What is ESG ?

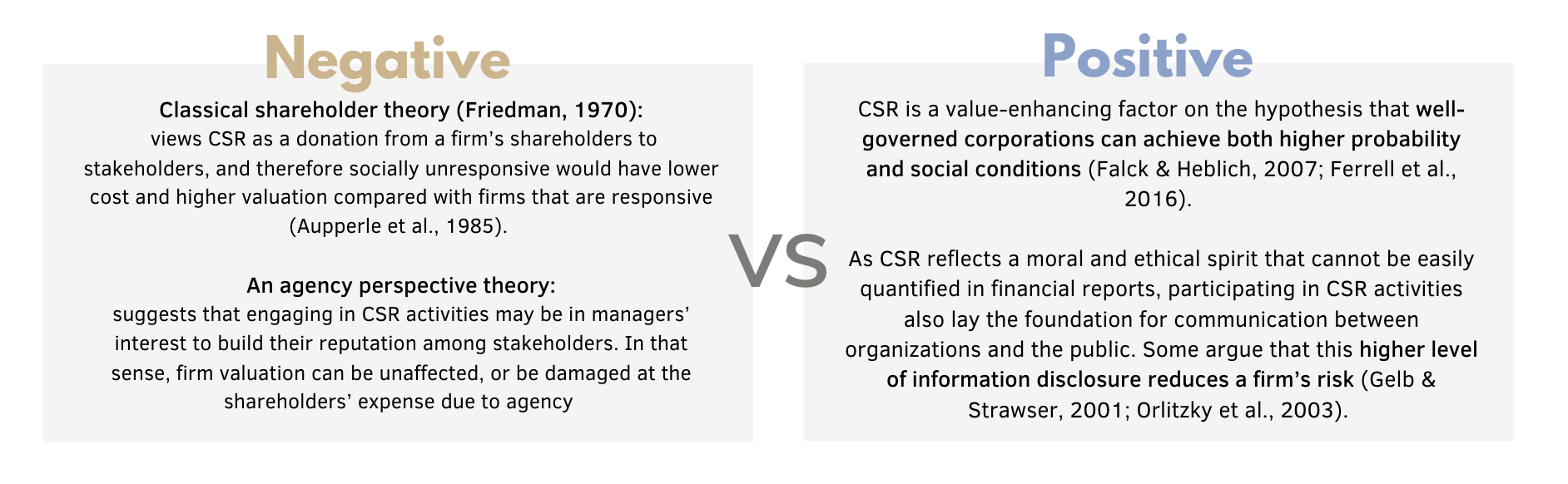

Environmental, Social and Governance (ESG) criteria are a set of standards designed to evaluate how socially conscious are the companies in the three areas. It has rooted in “Corporate social responsibility” (CSR), which originally, was a form of business self-regulation that companies contribute to societal goals voluntarily, and turned into a more sophisticated business model that companies leverage as a strategy. At present, the international maintream practice of CSR focuses on the three dimensions of ESG.

In 2005, the idea to integrate ESG issues into investment analysis was first introduced at the Who Cares Wins conference. Such analysis has drawn much attention due to its potential profitability and the underlying civic responsibility, and since then many organizations have developed criteria for ESG factors, known as ESG ratings.

What happened to the U.S. stock market during early pandemic?

Under globalization and urban sprawl, the contagious disease outbreaks on a global scope have forced humans to establish new boundaries and draw safe distances from one another to contain the spreading. The required isolation on the individual level soon brought about drastic changes in a connected world. The sudden halt of work, the crashing of medical system and more, these factors coupled and interacted, jointly amplifying the impacts on the economy.

Without a foreseeable solution, the substantial uncertainty led to several market crashes during the early pandemic, notably the triggering of market-wide circuit breaker for 4 times in the US equity market. S&P500 Index fell from 3,386 points on 21 February to a low of 2,337 points on 24 March, which was a drop of nearly 1,050 points (30%).

Consequently, there is growing attention on the search for low-risk and high-performance investments. Among the strategies, the trends of environmental, social and governance (ESG) stocks’ integration in investors’ portfolio choice decisions have been rising remarkably (Rubbaniy et al., 2021). However, existing literatures present mixed evidence regarding the association between ESG, risk and performance.

Why Covid-19 market crashes are suitable for analyzing stock price resilience?

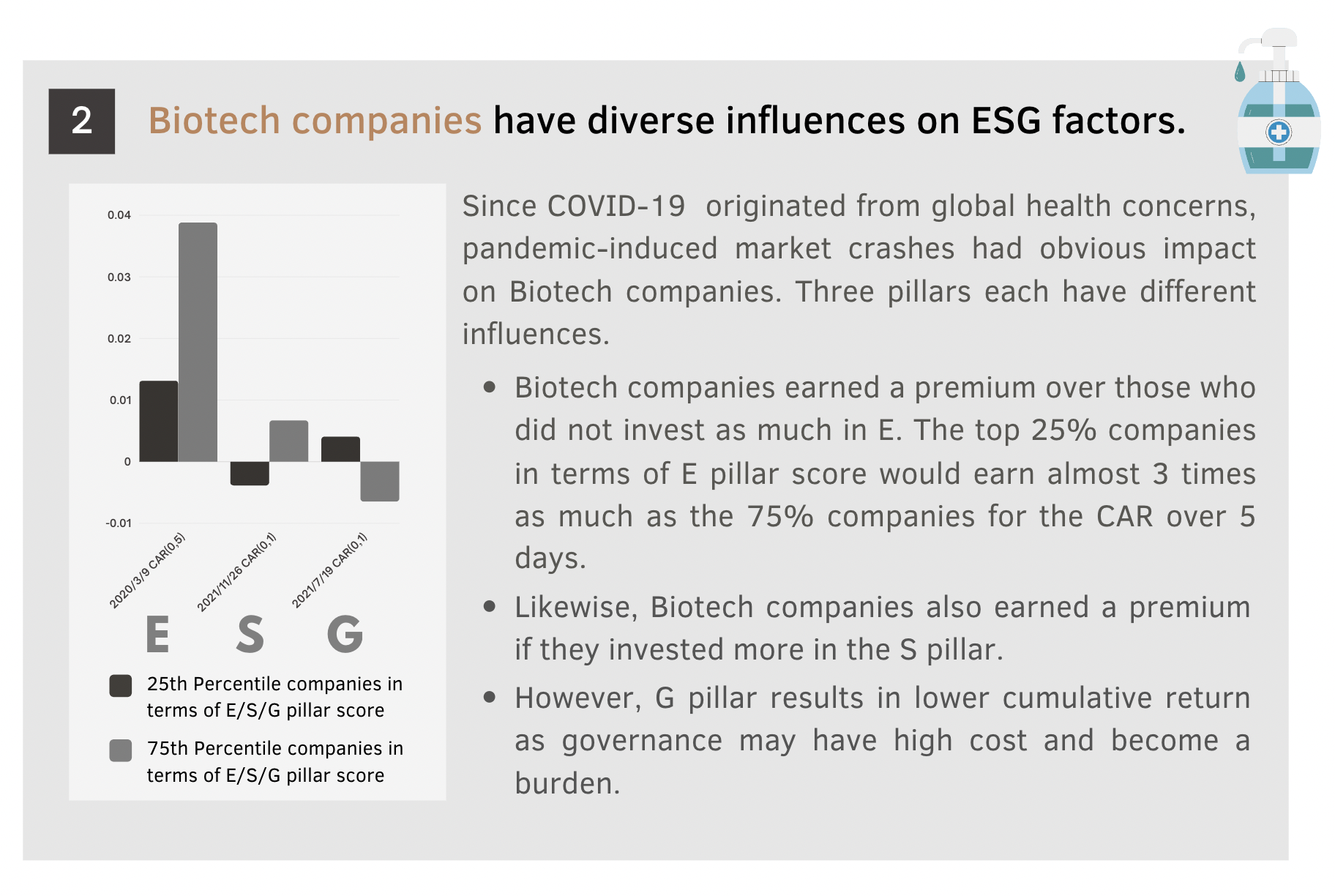

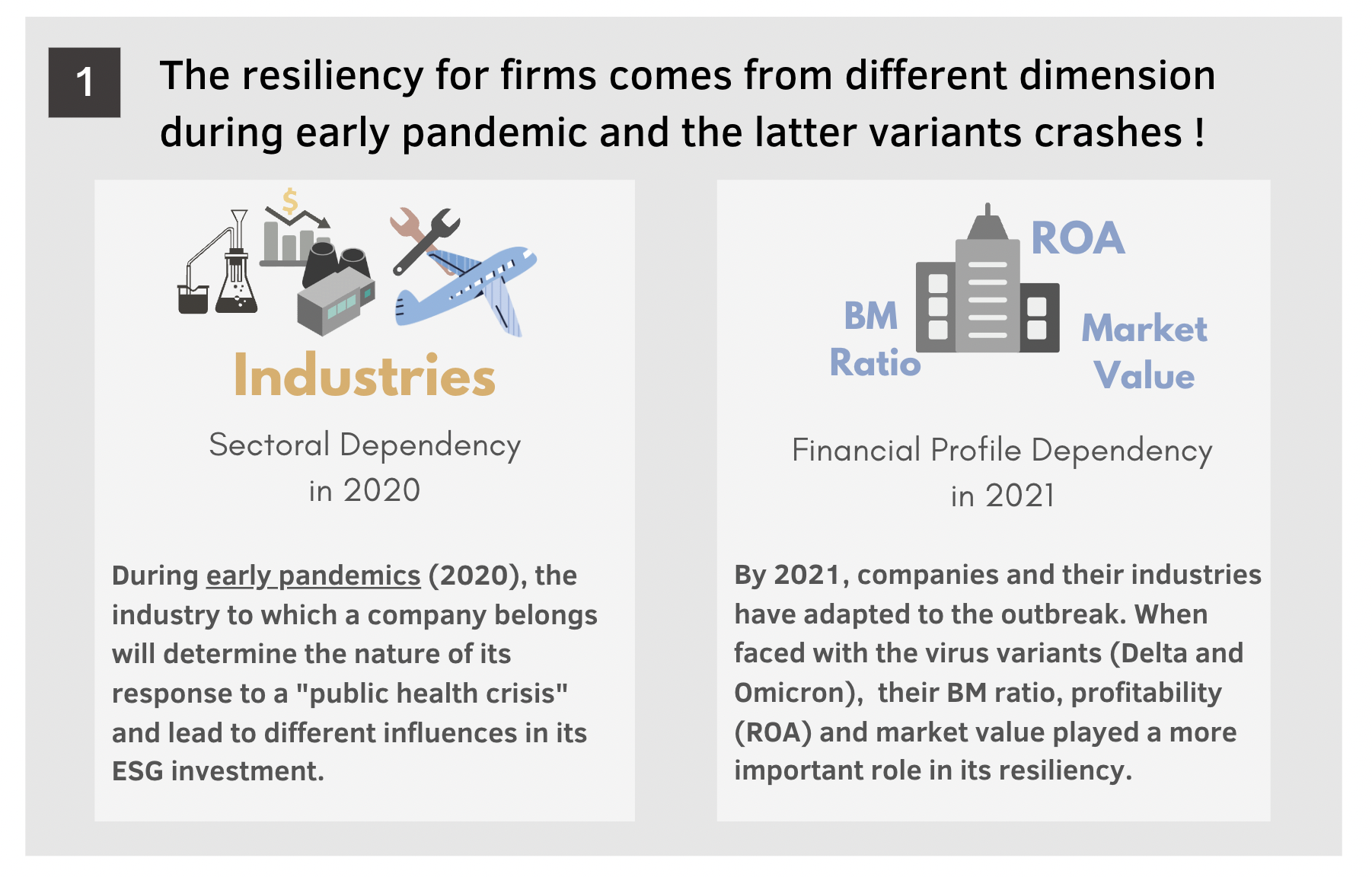

Unlike other financial crises, COVID-19 is a pandemic-induced market crash that originated from global health concerns. The unexpected and exogenous nature of the shock suggests that firms had very limited ability and time to respond (Albuquerque et al., 2020). Therefore, we argue that the COVID-19 market crash revealed the natural endurance of the firms, which allows us to investigate whether ESG activities can build up resiliency for firms.

Yes, Of course.

The effect of CSR during times of financial crises:

- Cornett et al. (2016) has found positive relationship between banks’ CSR quality and their financial performance during 2008, the Financial Crisis.

- Lins et al. (2017) estimate various regression models on MSCI ESG Stats, showing that non-financial firms which are socially responsible had higher stock returns during 2008 Financial Crisis.

Several recent studies have investigated the current COVID-19 crisis.

- Albuquerque et al. (2020) and Ding et al. (2021) find that better ESG-rated firms have a higher stock return and lower stock volatility in the US market.

- Following Albuquerque, Gianfrate et al. (2021) examine the resiliency of the global market, yet they find little evidence that higher ESG leads to better performance, except for the markets in North America. This suggests a geography dependency over the relationship.

- On the contrary, Bae et al. (2021) and Demers et al. (2021) find that ESG ratings are unrelated to firms’ performance in the US market.

About the ESG data

Our main data source for ESG performance is Thomson Reuters’ MarketPsych Refinitiv ESG database. It measures the ESG score through real-time global news and social media through NLP engine. MarketPsych Refinitiv ESG database covers the following areas for each pillar:

Each pillar score ranges from 0-100.

About the methodology

Event Study

In the field of finance, an event study is an empirical analysis that employs statistical methods to examine the behavior of firms’ stock prices around corporate events. The event should be unexpected to the capital market to better reflect its impact. We picked 4 event days across the pandemic:

- 2020/3/9: The Dow Jones Industrial Average triggered trading “circuit breakers” to curb panic selling this day, which is also referred to as Black Monday I.

- 2020/3/16: the third time the US stock market has hit circuit breakers in March 2020. This is the biggest one-day point loss in Dow Jones History and the CBOE volatility index closed at 82.69 on the same day, the highest ever closing in history.

- 2021/7/19: The fast-spreading of Delta variant had ignited fears of people, resulting in a plunge in the stock market.

- 2021/11/26: The discovery of the new Omicron variant in South Africa once again led to a stock crash, being the biggest drop of 2021.

We make use of the market model to obtain normal returns, with an estimation period from June 2018 to Dec 2021. The calculation of abnormal return for each firm i at event day t is defined as:

For a single event, we want to measure its total impact over a particular time period. We construct multiple event windows for cumulative abnormal return (CAR) in interest of capturing the speed of adjustment to the information. The CAR ranges from time t_1 to t_2, which compounds each corporate’s abnormal returns:

For the choice of event window, we include AR(t=0), (+1, -1), (+3, -3), (+5, -5) to consider a few trading days before and after the event day. We also include (0, 1), (0, 3), (0, 5) to focus on just the impacts after the event day.

Empirical Design

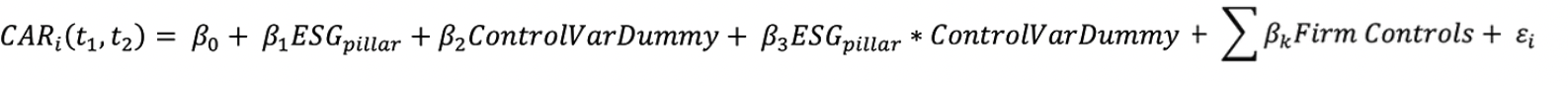

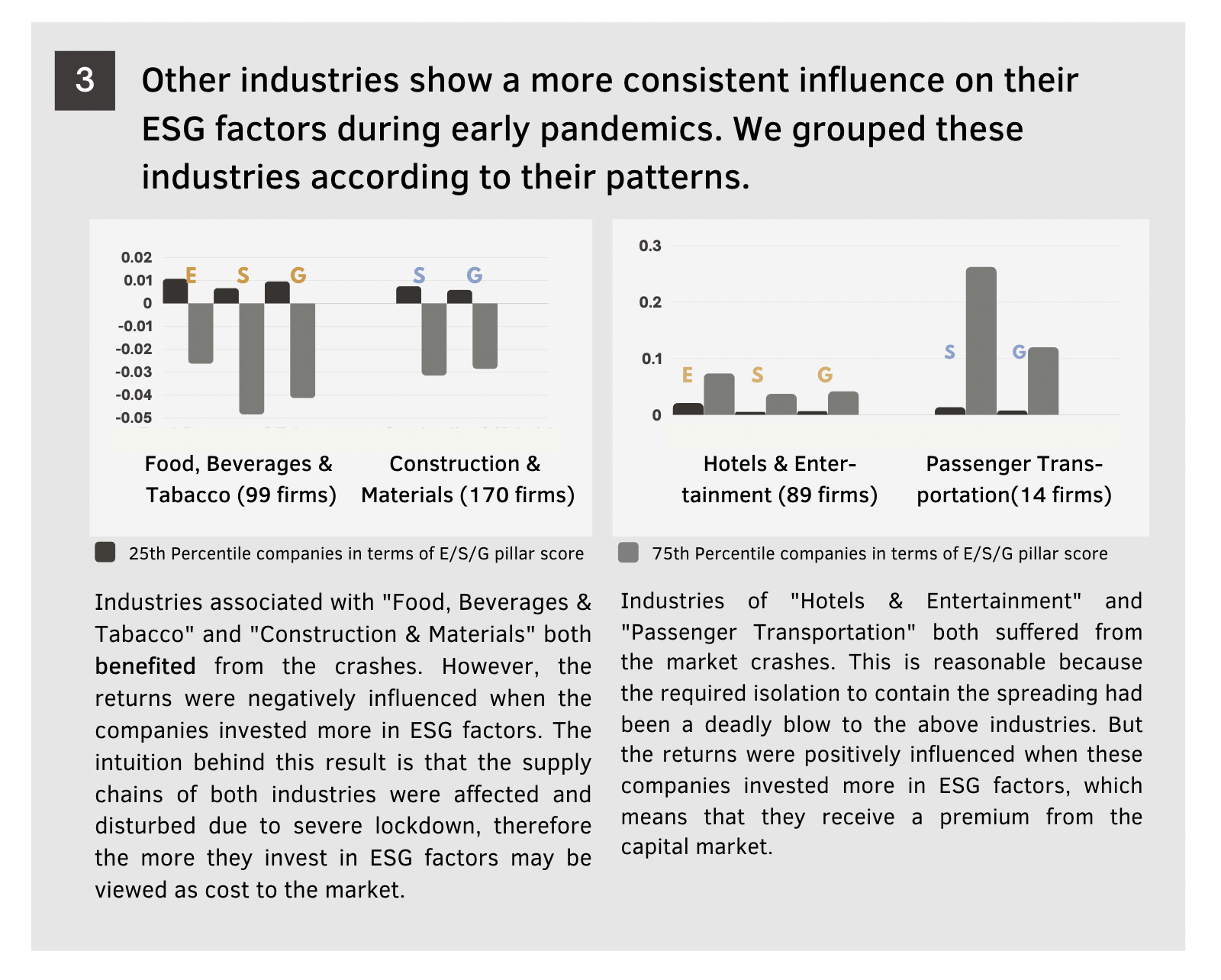

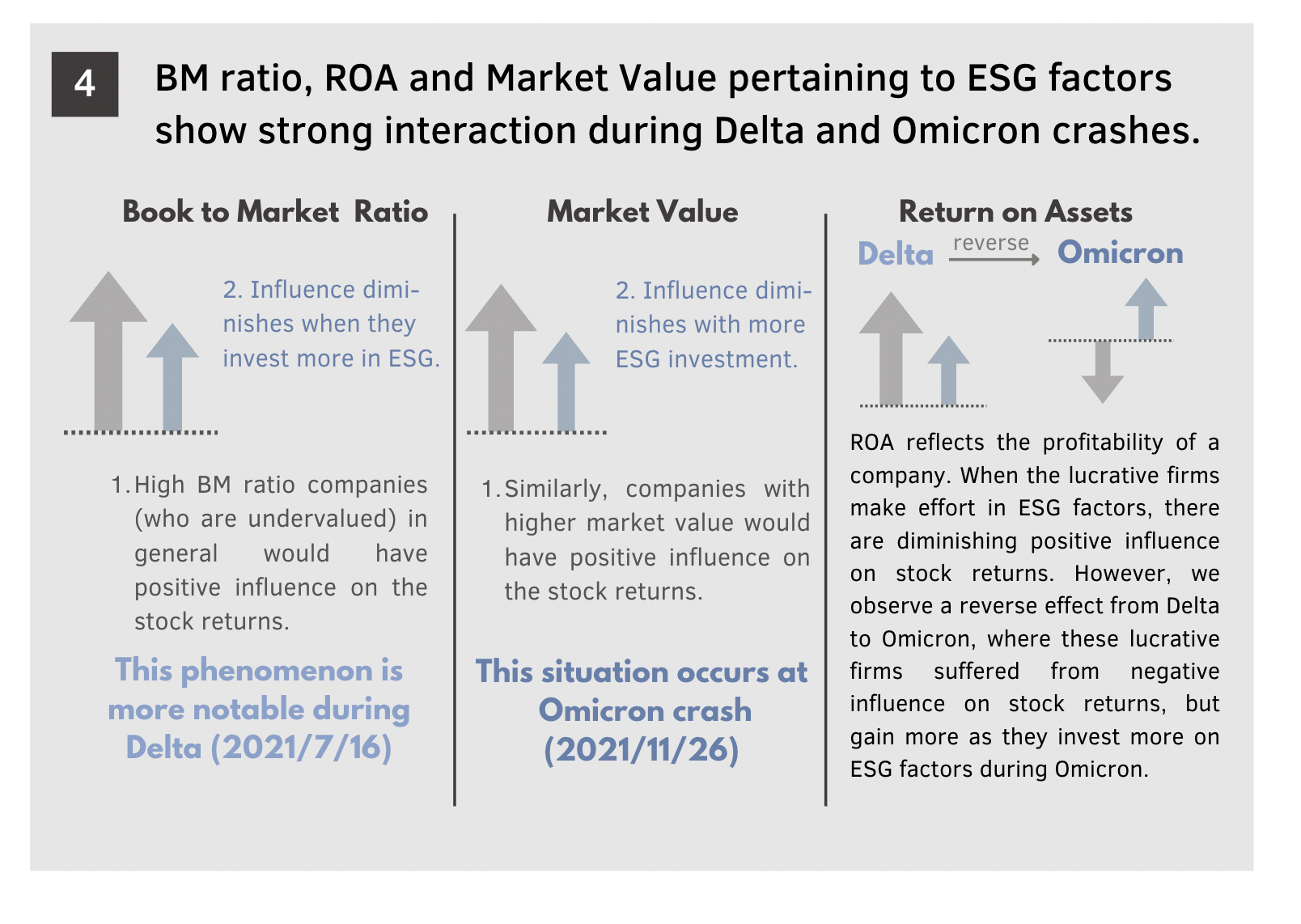

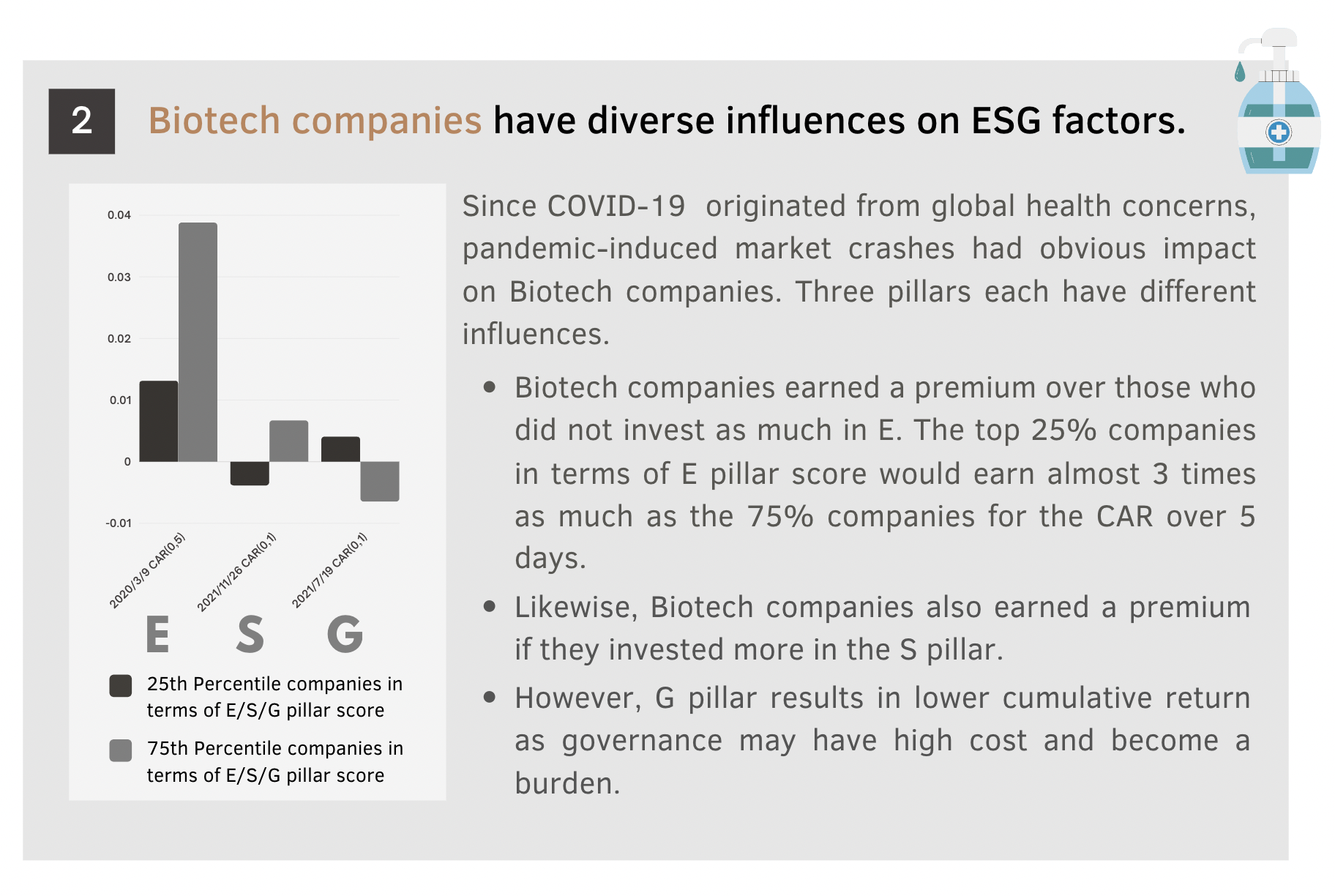

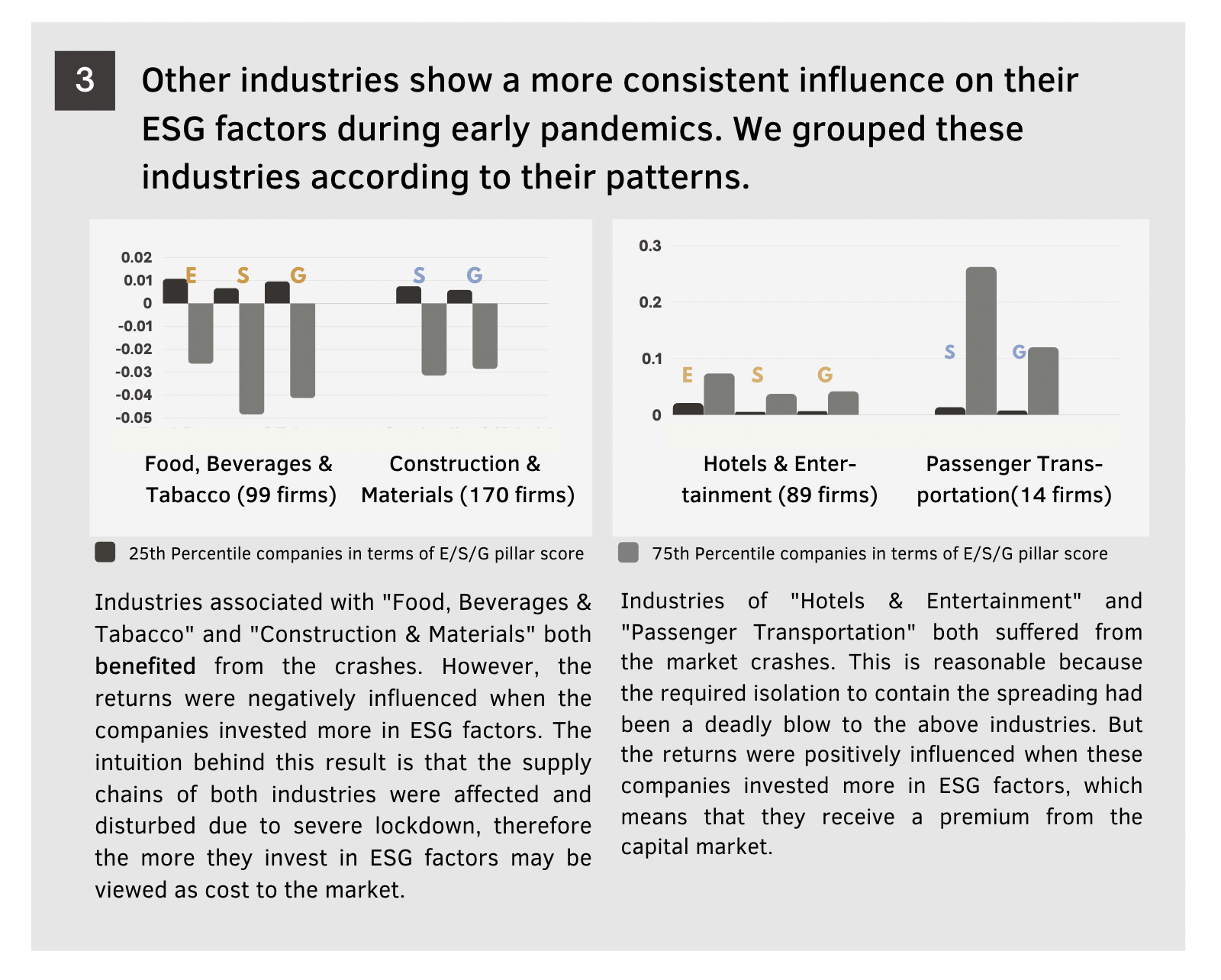

We ran two sets of experiments. Using firm cumulative abnormal returns (CAR) as dependent variables, we want to see the influences of every ESG pillar for the cumulative abnormal returns. And we focus on the sectoral and financial profile dependency on the ESG influence during these COVID-19 event days.

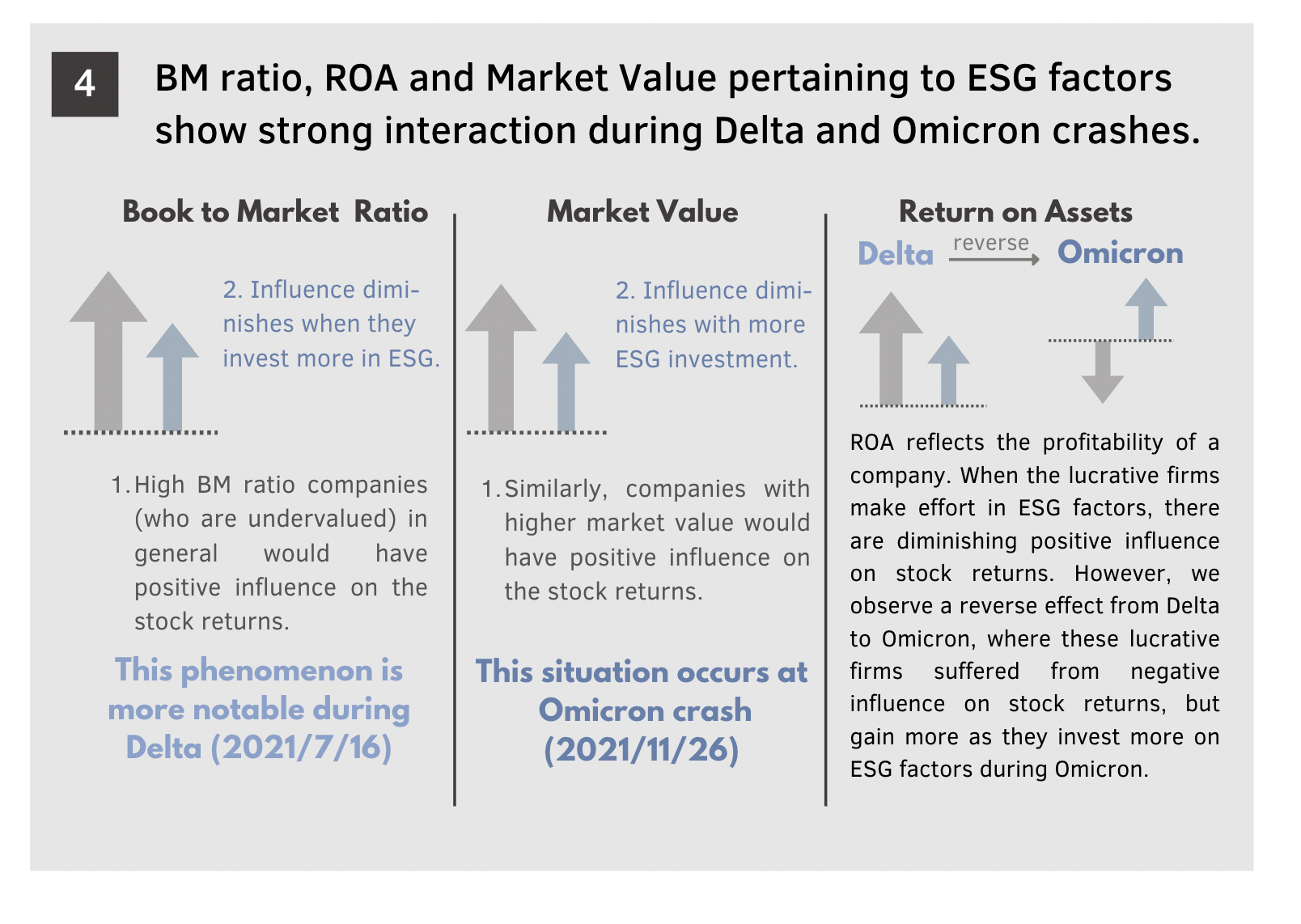

To eliminate the noises of company size, market value and profitability, we introduce control variable that fix the difference, including BM ratio, logarithmic market value, ROA and asset growth.

- Sector dummy variable interaction

We examined the following industires/sectors: Energy, Materials, Industrails, Consumer discretionary, Comsumer Staples, Health care, Financials, Information Technology, Communication services, Utilities, Real Estate. And we further examine the following sub-industries: Biotech, (Food, Beverages and Tabacco), Hotels & Entertainment, Passener Transportation.

- Financial profile interaction

We examined the following control variables: BM ratio, logaritmic market value, ROA and asset growth.

Key findings and analysis

Conclusion

This study examines the stock price resilience of 3,101 US listed ESG stocks through event study. We believe the promotion of ESG in the past few years have caused a growing acknowledgement of sustainability, and how it can further bring positive impact on environment and the firms’ operation. Although investment on ESG can be a burden and cost to companies, it may gain recognition over the capital markets that creates a premium for them. Our evidences show that when faced with COVID-19 market crashes, companies with better financial characteristics, such as good profitability or big market value, have higher chances of forming a premium. The influences are also sectoral dependent, which is in line with the idea that ESG factors are context-specific. Finally, we also show that there is a difference in the resilience of how firm reacted to early COVID-19 propagation period and the latter virus variants market crashes.

Reference

- Albuquerque, R., Koskinen, Y., Yang, S., & Zhang, C. (2020). Resiliency of environmental and social stocks: An analysis of the exogenous covid-19 market crash. The Review of Corporate Finance Studies, 9 (3), 593–621.

- Aupperle, K. E., Carroll, A. B., & Hatfield, J. D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of management Journal , 28 (2), 446–463.

- Bae, K.-H., El Ghoul, S., Gong, Z. J., & Guedhami, O. (2021). Does csr matter in times of crisis? evidence from the covid-19 pandemic. Journal of Corporate Finance, 67, 101876.

- Barber, B. M., & Lyon, J. D. (1997). Detecting long-run abnormal stock returns: The empirical power and specification of test statistics. Journal of financial economics, 43 (3), 341–372.

- B ́enabou, R., & Tirole, J. (2010). Individual and corporate social responsibility. Economica, 77 (305), 1–19.

- Cornett, M. M., Erhemjamts, O., & Tehranian, H. (2016). Greed or good deeds: An examination of the relation between corporate social responsibility and the financial performance of us commercial banks around the financial crisis. Journal of Banking & Finance, 70 , 137–159.

- Demers, E., Hendrikse, J., Joos, P., & Lev, B. (2021). Esg did not immunize stocks during the covid-19 crisis, but investments in intangible assets did. Journal of Business Finance & Accounting, 48 (3-4), 433–462.

- Ding, W., Levine, R., Lin, C., & Xie, W. (2021). Corporate immunity to the covid-19 pandemic. Journal of Financial Economics, 141 (2), 802–830.

- Engelhardt, N., Ekkenga, J., & Posch, P. (2021). Esg ratings and stock performance during the covid-19 crisis. Sustainability, 13 (13), 7133.

- Falck, O., & Heblich, S. (2007). Corporate social responsibility: Doing well by doing good. Business horizons, 50 (3), 247–254.

- Ferrell, A., Liang, H., & Renneboog, L. (2016). Socially responsible firms. Journal of financial economics, 122 (3), 585–606.

- Friedman, M. (1970). A theoretical framework for monetary analysis. journal of Political Economy, 78 (2), 193–238.

- Gelb, D. S., & Strawser, J. A. (2001). Corporate social responsibility and financial disclosures: An alternative explanation for increased disclosure. Journal of Business Ethics, 33 (1), 1–13.

- Gianfrate, G., Kievid, T., & van Dijk, M. (2021). On the resilience of esg stocks during covid-19: Global evidence. COVID Econ, 25 , 83.

- Hanlon, M., & Slemrod, J. (2009). What does tax aggressiveness signal? Evidence from stock price reactions to news about tax shelter involvement. Journal of Public economics, 93 (1-2), 126–141.

- Kr ̈uger, P. (2015). Corporate goodness and shareholder wealth. Journal of financial economics, 115 (2), 304–329.

- Lins, K. V., Servaes, H., & Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. the Journal of Finance, 72 (4), 1785–1824.

- McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Academy of management review , 26 (1), 117–127.

- Nisar, T. M., & Yeung, M. (2018). Twitter as a tool for forecasting stock market movements: A short-window event study. The journal of finance and data science, 4 (2), 101–119.

- Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization studies, 24 (3), 403–441.

- Ramelli, S., & Wagner, A. F. (2020). Feverish stock price reactions to covid-19. The Review of Corporate Finance Studies, 9 (3), 622–655.

- Rubbaniy, G., Khalid, A. A., Rizwan, M. F., & Ali, S. (2021). Are esg stock safe-haven during covid-19? Studies in Economics